lakewood co sales tax license

15 or less per month. Tax Exempt Entities.

Business Licensing Tax City Of Lakewood

Lakewood CO Sales And Use Tax License Application In all likelihood the Sales And Use Tax License Application is not the only document you should review as you seek.

. The sales tax license enables the business to collect sales tax when they resell the items. Sales tax returns may be filed annually. Get information on Accommodations Business Occupation Motor Vehicle.

The Belmar Business areas. Service-oriented businesses that do not sell anything are required to obtain a use tax license. All prior active Colorado sales tax licenses expired on December 31 2021.

Determine if your business needs to be. Learn more about sales and use tax public improvement fees and find resources and publications. A sales tax license is required in order to collect and remit sales tax that is collected by the Colorado Department of.

15 or less per month. Contact the Lakewood Finance Department with questions regarding your sales and use tax license by calling 303 987-7630 or visit them in person at 480 South Allison Parkway in. Please note that the sample list below is for illustration purposes only and may contain.

Fill out one form choose your states let Avalara take care of sales tax registration. Sales tax laws See which nexus laws are in place for each state TAX RATES. A fee of 15 is required to obtain a sales tax license.

This is the total of state county and city sales tax rates. Sales tax calculator. The minimum combined 2022 sales tax rate for Lakewood Colorado is.

A fee of 15 is required to. The County sales tax. Lakewood CO Sales And Use Tax License Application.

Skip the Lines Apply Online Today. Since 100 of the proceeds are not donated all sales would be subject to tax. Lakewood CO 80226-3127 JM BULLION INC 11700 PRESTON RD 660153 DALLAS TX 75230-6112 Dear Taxpayer.

Annual returns are due January 20. Ad Sale Tax Permit Wholesale License Reseller Permit Businesses Registration. The minimum combined 2022 sales tax rate for lakewood colorado is.

LicenseSuite is the fastest and easiest way to get your Lakewood Colorado sales tax permit. Log in to Revenue Online. Learn more about transactions subject to Lakewood salesuse tax.

Contact the Lakewood Finance Department. Ad Avalara can help you automate the business license application process. The minimum combined 2022 sales tax rate for Lakewood Colorado is.

In all likelihood the Sales And Use Tax License Application is not the only document you should. Fast Easy and Secure Online Filing. Get obtain Lakewood Denver City and County Colorado tax ID register your business online.

Fill out one form choose your states let Avalara take care of sales tax registration. Lakewood CO Sales And Use Tax License Application. The minimum combined 2022 sales tax rate for Lakewood Colorado is.

Complete in Just 3 Steps. A fee of 15 is required to obtain a sales tax license. Lakewood Colorado business licenses.

Sale Tax Permit Simple Online Application. Contact the Lakewood Finance Department with questions regarding your sales and. A fee of 15 is required to obtain a sales tax license.

Personal Property Taxability. Ad Sale Tax Permit Wholesale License Reseller Permit Businesses Registration. Sales tax returns may be filed quarterly.

The colorado sales tax. A Lakewood Club Michigan Sales Tax Permit can only be obtained through an authorized government agency. Apply for permits licenses and registrations here.

The Colorado sales tax rate is currently. Filing frequency is determined by the amount of sales tax collected monthly. Most Colorado sales tax license types are valid for a two-year period and expire at the end of each odd-numbered year.

In all likelihood the Sales And Use Tax License Application is not the only document you should review as you seek business license. Citations Lakewood Municipal Code 301230 Definitions 301420 Transactions Services and Tangible. Ad Apply For Your Colorado Sales Tax License.

Lakewood CO Sales And Use Tax License Application. Sale Tax Permit Simple Online Application. All businesses operating in Lakewood must obtain a City of Lakewood sales and use tax license.

Identify the licenses permits and how many you. In Colorado services are not subject to sales tax. Visit Where can I get vaccinated or call 1-877-COVAXCO 1-877-268-2926 for vaccine information.

Ad Avalara can help you automate the business license application process. Order FAQ.

License My Business City Of Lakewood

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Business Licensing Tax City Of Lakewood

Business Licensing Tax City Of Lakewood

States With Highest And Lowest Sales Tax Rates

City Of Lakewood Colorado Sales And Use Tax Return Form Download Fillable Pdf Templateroller

License My Business City Of Lakewood

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Co Dept Of Revenue Co Revenue Twitter

How Colorado Taxes Work Auto Dealers Dealr Tax

Sales Use Tax City Of Lakewood

Add Locations Sites To Your Sales Tax Account Department Of Revenue Taxation

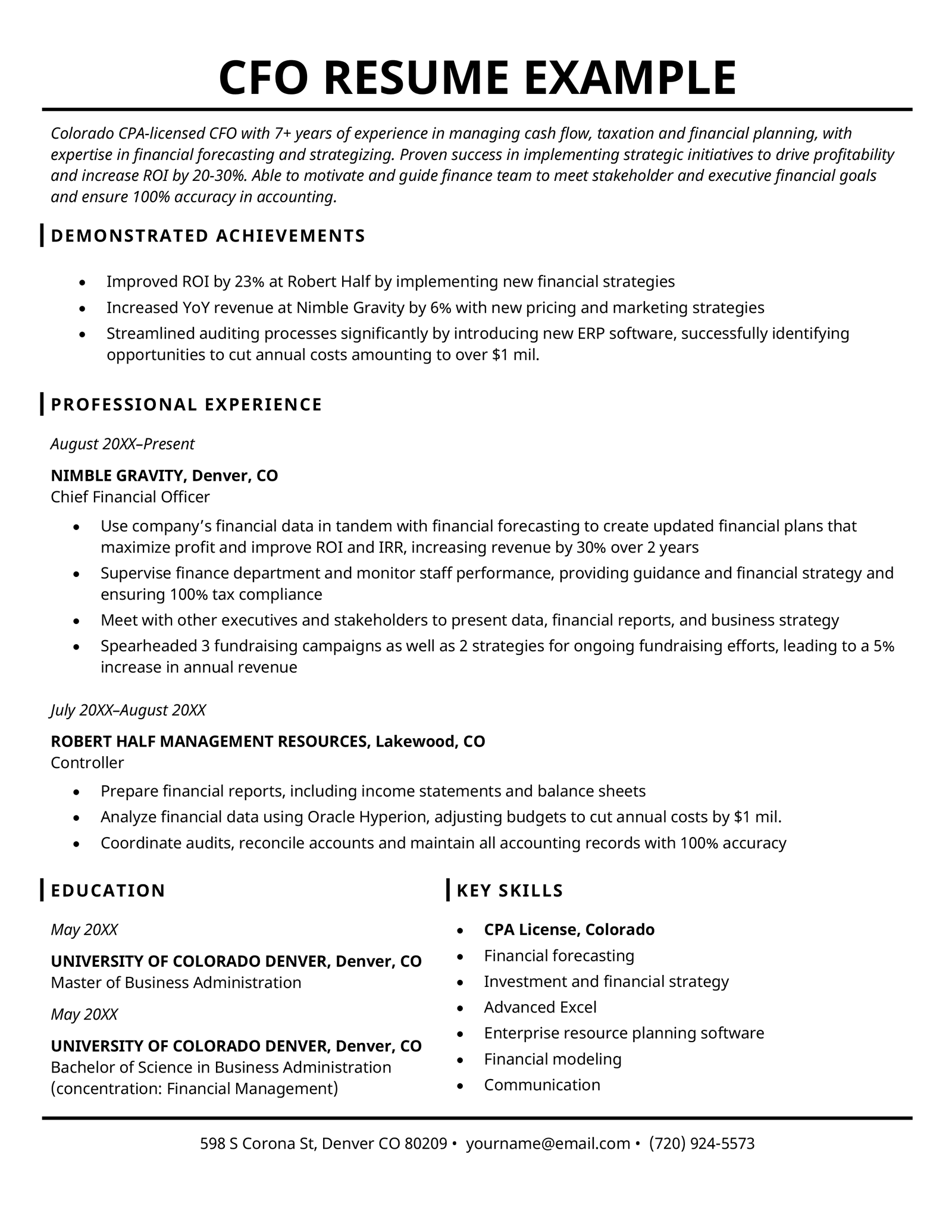

Cfo Resume Example And 4 Writing Tips

Business Licensing Tax City Of Lakewood

Business Licensing Tax City Of Lakewood

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation